142015 and comprises the following sections. The sample population study uses tax audit cases obtained from the CMS System for 80 company tax audit cases completed at the.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

The Royal Malaysia Customs Department RMCD issued an Audit Compliance Framework on 30 April 2019 to ensure taxpayers comply with the relevant law and regulations.

. Tax audit investigation issues highlighted. INLAND REVENUE BOARD MALAYSIA November 2000. Tax Audit In Malaysia.

This new 19-page TAF replaces the earlier TAF 2015 TAF that was effective from 1 June 2015 see Tax Alert No. The years of assessment to be covered in a tax audit may however be extended depending on the issues identified during an audit. Talking about the top 10 audit firms in Malaysia 2020 we have created the most authentic and unbiased list of accountants and auditing service providers.

Tax Leader PwC Malaysia 60 3 2173 1469. From Tax Audit in Malaysia to Home Page. Each audit firm offers a variety of services including tax accounting auditing consulting and financial advisory to the businesses.

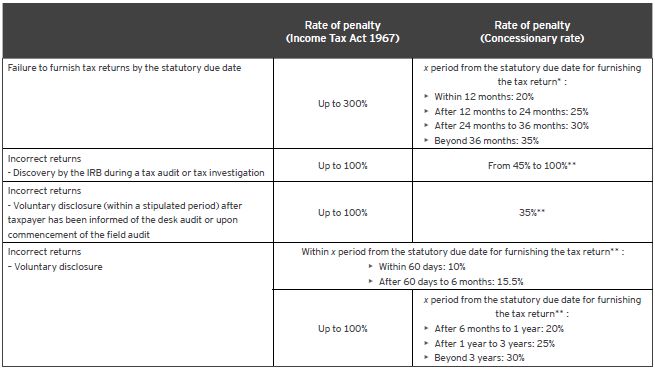

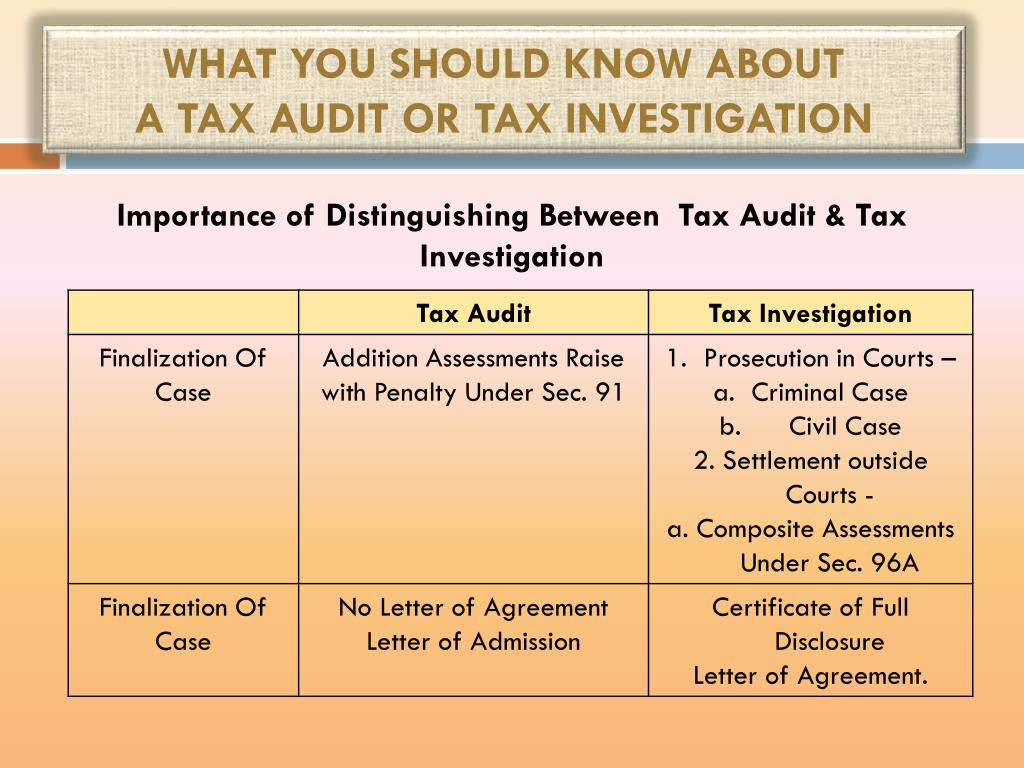

Managing tax audit and investigation risks proactively. Tax investigation involves the inspection of the business of the taxpayer as well as individual books. Failure to furnish an Income Tax Return Form.

Just like many other countries Malaysia does have tax investigation. A tax audit may cover a period of one to three years of assessment determined in accordance with the audit focus. 52 However the tax audit may be extended to cover a period up to five 5 years of assessment pursuant to the issues uncovered during an audit.

01 February 2015. YYC Advisors Perspective On The Self-Assessment System. Certain companies are exempt from filing audited accounts.

51 Generally a tax audit covers a period of one 1 year of assessment determined in accordance with the audit focus criteria of the department. Field Audit Process the Role of Tax Agents. Shorter time frame for settlement of a tax audit ie.

Under the self assessment regime any non-compliance will potentially attract. The Inland Revenue Board of Malaysia IRB conducts tax audits to ensure that taxpayers have declared the right amount of income in their income tax returns in accordance with current tax laws and regulations. No32 34 Lorong Thambi 2 off Jalan Brunei 55100 Kuala Lumpur.

Malaysia operates a self-assessment tax system and tax returns must be filed within seven months of the companys year-end. A taxpayer can be selected for audit at any time to ascertain that the amount of tax. Make an incorrect tax return by omitting or understating any income.

RM200 to RM20000 or imprisonment not exceeding six months or both. Superceded by the Tax Audit Framework on Finance and Insurance 01052022 - Refer Year 2022. No32 34 Lorong Thambi 2 off Jalan Brunei 55100 Kuala Lumpur.

52 However the tax audit may be extended to cover a period up to five 5 years of assessment pursuant to the issues uncovered during an audit. TAX AUDIT FRAMEWORK INLAND REVENUE BOARD Amendment 12015 MALAYSIA Effective date. 90 calendar days instead of 120 calendar days from the commencement date of audit visit or the date of the Surat Penentuan Permulaan Tempoh Penyelesaian Kes is issued whichever applicable for cases in relation to business activities related to financial leasing.

税務当局は5月1日に所得税に関する税務調査の指針Tax Audit Framework 2022を発表しましたこれは所得税の税務調査に関する指針で2019年に発行された同指針に置き換わることになります. Failure to give notice of changeability to tax. Direct tax is a tax that is levied directly on the taxpayers disposable income.

There are two types of tax audits that can be carried out by the IRB namely desk audits and field audits. RM1000 to RM10000 and 200 of tax. Audit Framework For Employer available in Malay version only 01102021.

These companies must have no more than 20 members and none of whom are corporations having a direct or indirect interest in its shares. From Tax Audit in Malaysia to Tax Accounting Audit and Business Issues in Malaysia. While on the other hand indirect tax such as Sales Services Tax that was implemented on 1 September 2018 replacing Goods and Service Tax GST are tax being levied on taxpayers when they consume goods and services.

Customs audit GSTSST. Some cannot even differentiate between the Inland Revenue Board IRB and Royal Malaysian Customs Department RMC said KPMG Malaysia executive. In Malaysia tax is levied in direct and indirect form.

Tax audit is a primary activity of the tax authorities under the Self Assessment System SAS in enhancing and encouraging voluntary compliance with the tax laws and regulations. Tax Audit Framework On Finance and Insurance. RM200 to RM20000 or imprisonment not exceeding six months or both.

Tax audit is a regular routine inspection of a taxpayers business financial record to ensure that they are compliance with tax laws and regulations. It also ensures that a higher tax compliance rate is achieved under the SAS. The Inland Revenue Board IRB has issued on its website the updated Tax Audit Framework Finance and Insurance TAF dated 18 November 2020.

This booklet is intended to help taxpayers understand better the procedures and requirements of a tax audit and the rights and responsibilities of those who are selected for an audit. 01 February 2015 _____ i. Return from Tax Audit to Home Page.

The IRB also recently issued the revised Tax Audit Framework 2019 Tax Audit Framework for Transfer Pricing 2019 and Tax Investigation Framework 2020. In Malaysia the Malaysian Inland Revenue Board IRBM serves as the institution responsible for managing income tax which is the countrys direct tax and is a major contributor to most of the countrys income. Malaysia operates a self assessment system where tax audits are an essential tool used by the Inland Revenue Board IRB to ensure taxpayers are in compliance with the relevant tax laws and regulations.

Taxpayers and audit officers and what generally is expected of them during the course of an audit are also mentioned.

Malaysia Payroll And Tax Activpayroll

What Happens When You Get Your Malaysia Income Tax Audited

Income Tax Offences Fines And Penalties In Malaysia

Tax And Investments In Malaysia Crowe Malaysia Plt

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

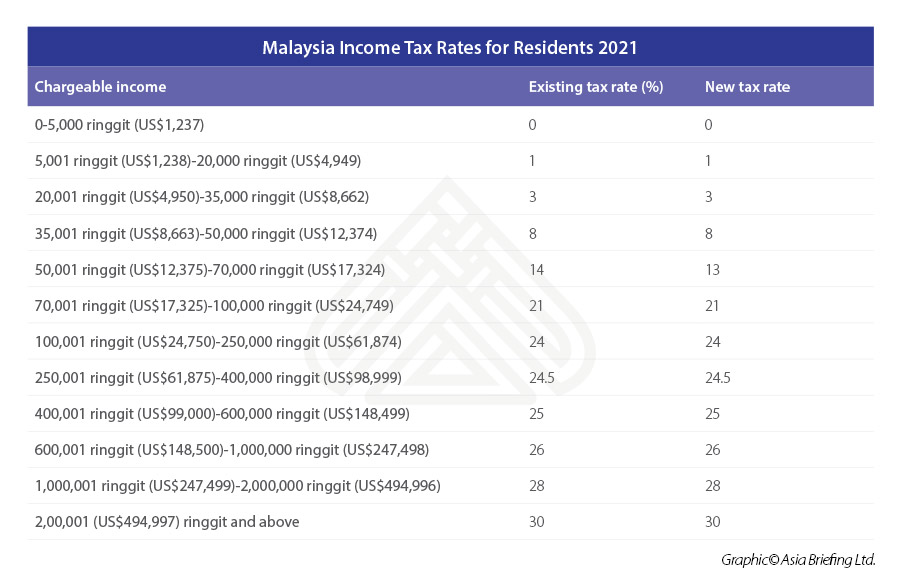

Malaysia Income Tax Rates For Residents 2021 Table Asean Business News

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

Recognition At The Itr Asia Tax Awards 2021

Transfer Pricing Tax Audits And Investigations

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Tax Audit Definition Example Explanation And Types Wikiaccounting

Sales And Service Tax 2018 Sst In Malaysia Tax Taxact Bad Debt

Tax Implications On Digital Services Crowe Malaysia Plt

Irs Can Audit Your Taxes Forever If You Miss A Key Form

Setting Up Practice In Malaysia

Ppt What You Should Know About A Tax Audit Or Tax Investigation Powerpoint Presentation Id 5261502

Lhdn Tax Filing Deadline Extended By 2 Months Rsm Malaysia

Here S 5 Common Tax Filing Mistakes Made By Asklegal My